Market Insights | August 2024

Published: 08/06/2024

By: Christopher Coyle, Idaho Trust Bank Chief Financial Officer

Market Insights

A periodic newsletter from Idaho Trust Bank

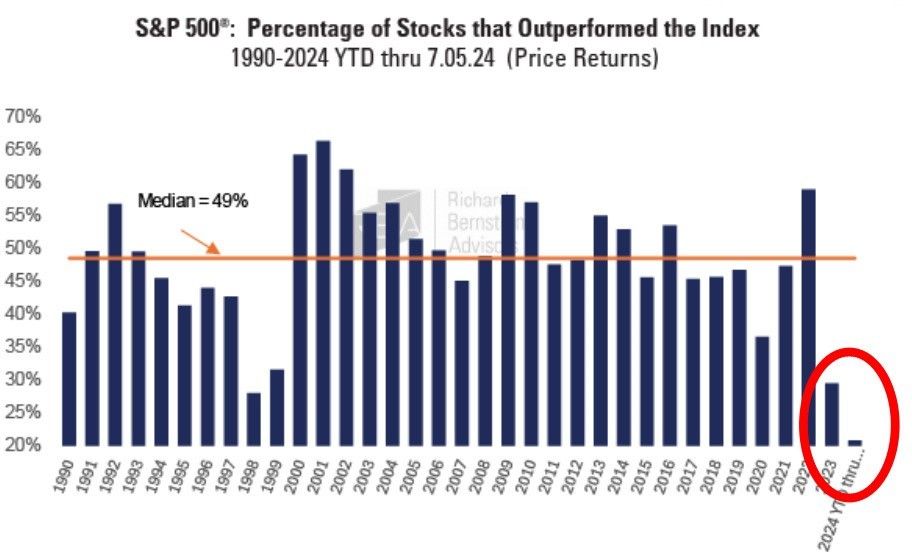

Most major stock indices have experienced a decent first half of the year. The healthy results were due in part to expectations that inflation pressures had subsided. Notably, the strong performance of the S&P 500 & Nasdaq indices was driven by a small group of large-capitalization stocks.

The possibility of a less restrictive monetary policy stance has caused interest rates to decline as investors priced in the possibility of the Fed cutting rates in the fall. However, the upcoming U.S. elections may impact the timing of any possible rate reduction as the Fed wants to appear impartial and not affect the election outcomes.

The Federal Reserve Bank

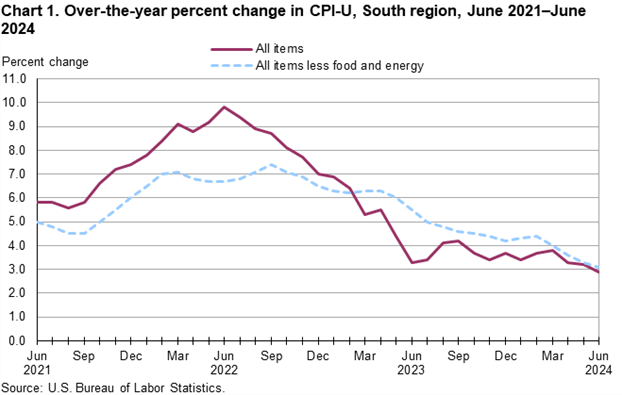

The Federal Reserve Bank last raised the Fed Funds rate in July 2023. The Fed has continued to hold a more restrictive monetary policy position in order to combat higher inflation levels. The past two Consumer Price Index (CPI) reports have experienced lower-than-expected inflation rates. In the most recent reading, the June CPI index declined 0.1% from the prior month, putting the 12-month rate at 3.0% (see chart on next page). This was the first decline since May 2020. The core CPI, excluding volatile food and energy pricing, increased 0.1% from May, representing a 3.3% gain from the year-ago period. The annual increase for the core rate was the smallest since April 2021.

A reduction in gasoline prices contributed to the moderation in price increases. This was partially offset by an increase in food and shelter costs.

Housing-related expenses have been one of the most stubborn components of inflation and represent approximately one-third of the weighting in the CPI calculation. While inflation rates have fallen from exceptionally high levels, getting closer to the 2% target rate appears to be more challenging than most had expected. As of this writing, expectations from market observers are that the Fed will reduce rates one or two times by the end of this year.

Second-Quarter Review

Although equity market performance was solid during the first half of the year, it was primarily driven by the largest stocks, which distorts expectations as the performance of the average stocks has been more muted (see

chart below). Artificial intelligence played a large role in this performance dispersion. It is important to remember that many financial market returns were exceptionally strong in 2023.

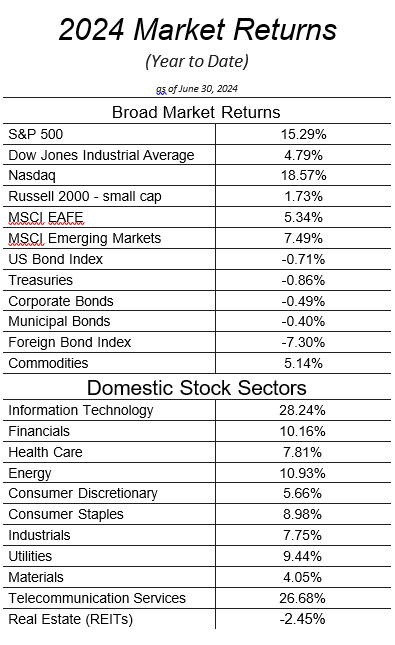

While the S&P500 and the Nasdaq advanced 15.29% and 18.57%, respectively, technology stocks advanced at a faster pace.

The Technology and Telecommunications Services sectors rose 28.24% and 26.68%, respectively, in the first half of 2024. Other sectors that experienced strong gains were Energy and Financials. The two groups with the weakest performance were REITs and Materials, likely related to higher interest rates and uncertainties surrounding future demand.

Conclusion

Given the uncertainty surrounding U.S. elections and monetary policy, financial markets are likely to remain volatile going into the fall. Therefore, these ambiguities, along with the divergence in investment performance across various asset classes, emphasize the importance of diversification in an uncertain world.

We believe that the long-term investment outlook remains solid with a healthy economic backdrop as well as higher rates which should benefit fixed-income returns going forward. The market will be closely watching for indications on future Fed policy, and earnings calls in the coming weeks.

1. Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/ dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes.

2. Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000.

3. Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank.

4. Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice.

5. Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may in-

clude higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No represen- tation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest.

6. Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results.

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards.

Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested invest- ment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest.

Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable, but is not guaranteed. Any opinions expressed are based on our interpretation of

data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice.

NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE

Rev. 6.30.2024 ©Idaho Trust Bank, 2024. All Rights Reserved.