September Trends and the 'September Effect' - [Market Insights: October 2023 Edition]

Published: 10/17/2023

By: Christopher Coyle, CFO Idaho Trust Bank

![September Trends and the 'September Effect' - [Market Insights: October 2023 Edition] September Trends and the 'September Effect' - [Market Insights: October 2023 Edition]](https://cdn.firstbranchcms.com/kcms-structure/af7e7bee-8543-4c91-b263-2dcca326c184/postImage.png)

Market Insights - October 2023

A periodic newsletter from Idaho Trust Bank

The job market has remained strong, corporate earnings seem solid, and consumer spending has not wavered. However, widespread risks remain. Progress on tackling inflation has faced hiccups, and tightening credit conditions are threatening growth in 2023 and 2024. Upcoming monetary policy decisions will be incredibly important – but have been complicated by recent volatility in the fixed-income markets.

The Federal Reserve Bank

The Federal Reserve did not raise rates in September – but kept its hawkish language, indicating rate increases are still on the table for the two meetings left this year. Investors appear to be concerned about high U.S. government debt levels. Higher interest rates inflate the cost of paying off existing and future debt. As a result of this, September saw a correction of bonds at the long end of the curve (effectively a repricing of long-term risk). Rates went up across the board in September – however, the selloff was primarily in longer-duration bonds. This has decreased the inversion of the yield curve, although it remains inverted.

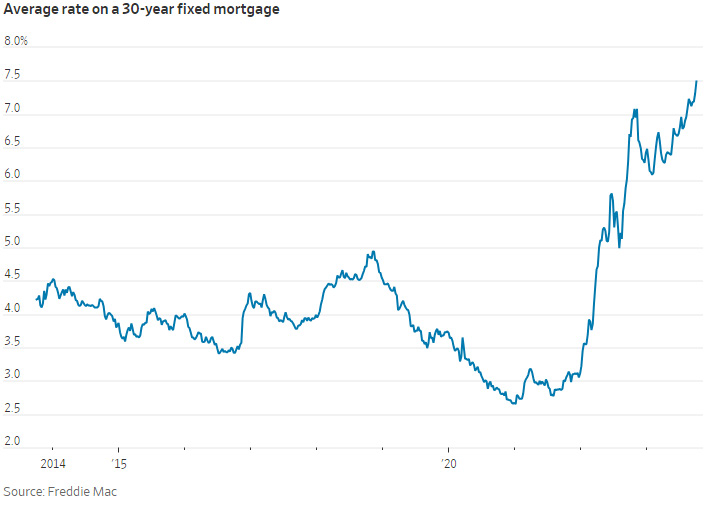

Mortgage rates recently hit a two-decade high, with the average 30-year fixed rate reaching 7.57%. The average rate has risen by half a point since August. This rise has coincided with the recent selloff in the fixed-income market. There has been a resulting decline in purchasing and refinancing activity. Most of the large publicly traded residential REITs are down around 8% YTD at the time of writing. Homebuilder stocks have fallen as well. XHB- the ETF tracking homebuilding companies, has fallen around 11.5% since September 1st. August saw the fewest housing starts since April 2020.

Another issue facing lenders is the commercial real estate sector. Since a high point in May 2022 – commercial real estate has declined about 16%, according to Green Street. While many businesses have returned to the office, significant vacancies remain. Office spaces have been hit the hardest, with an approximate 31% decline in value since the Federal Reserve started raising rates. Unlike mortgages, many commercial real estate loans are interest-only loans, meaning that the repayment of principal is made at the end of the loan rather than over the loan’s lifetime. With such a big downturn in commercial real estate, these repayments may pose a large risk for banks and other lenders. Those renewing or refinancing loans will face significantly higher rates. Morgan Stanley is reporting that roughly $900 billion of commercial real-estate loans need to be paid off or refinanced by the end of 2024. Although mortgage-backed securities helped cause the 2007-2008 financial crisis, more conservative lending standards have likely reduced their risk. Commercial mortgage-backed securities drew less scrutiny in the aftermath of the financial crisis and did not see the same increase in regulation and lending standards. There is no doubt that the commercial lending market will be a focal point for investors and regulators in the coming months.

Year-to-Date Recap

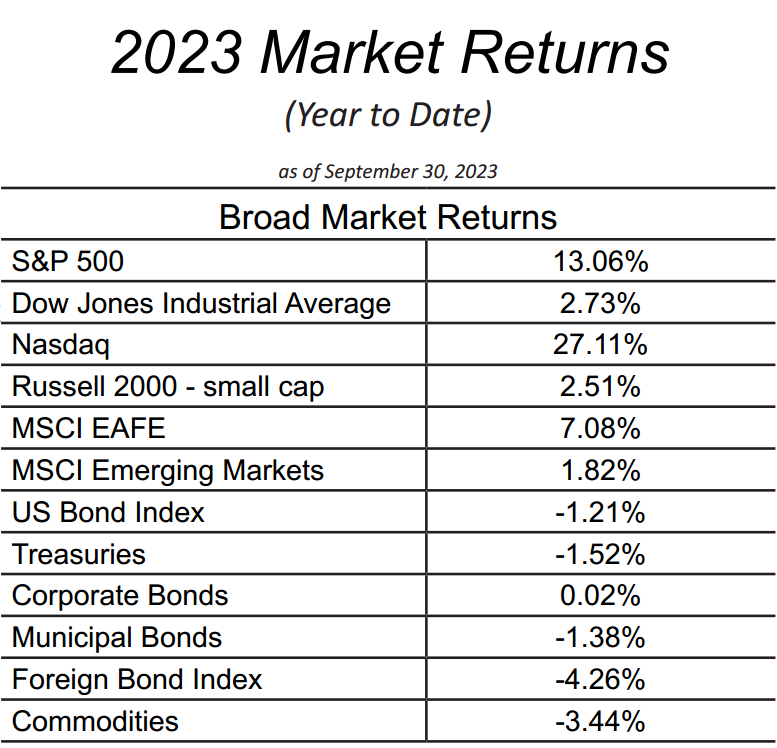

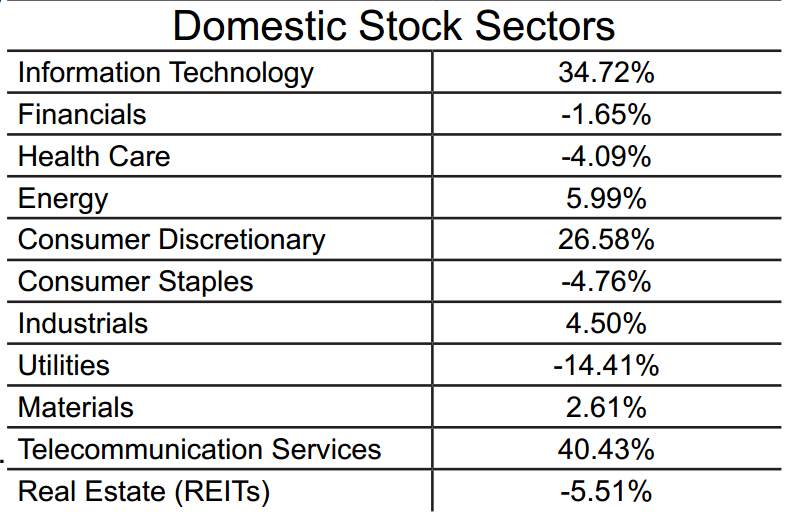

Stocks fell in September. This is not a big surprise – historically speaking, September is the worst month on average for the S&P500. Over the long term, the S&P500 averages about a 50 basis point increase per month; however, September sees an average decrease of about 75 basis points. While increasing yields will increase the discount rate at which stocks are valued (decreasing intrinsic value), this pullback can also be attributed to this “September effect.” Since many mutual funds end their fiscal year in September, investment managers often harvest losses or sell off risky positions so they do not come up on quarterly statements (window dressing). The price-to-earnings ratio of the S&P500 is around 24.85, well above the long-term average and median (16.03 and 14.94, respectively).

Energy prices have pulled back from recent highs but remain elevated from levels seen in the middle of the summer. OPEC reduced supply in July, and crude oil futures peaked at over $93 per barrel in late September (up from the low $60s in June). Prices eased in the first few days of October but have spiked again amid the conflict in the Middle East.

So far, financial markets seem to be mostly insulated from the most recent geopolitical issues. Oil prices had a small jump – but asset prices have been mostly stable outside of the conflict. The trading volume over the last few days indicates that foreign investors have moved money into “safe-haven” assets. Currently, the biggest financial concern for foreign investors is likely around energy prices and commodities. An increasing scope of the conflict could push prices higher.

Inflation data for September came out in mid-October. Headline inflation rose 0.4% in September (3.7% YoY), less than the 0.6% increase in August, but surpassed the consensus estimates. Core inflation matched expectations with a 0.3% increase. Much of the inflation has been reportedly driven by increasing wages. There have been notable strikes from big unions. United Auto Workers and Kaiser-Permanente Healthcare employees are two large groups on strike currently seeking higher wages. There have been other significant wage gains in other union contracts recently too, with many in the aviation industry successfully obtaining higher wages. Broad wage growth will keep pressure on the prices of basic goods and services.

_________________________________________________________