Market Insights - September 2023

Published: 09/08/2023

By: Christopher Coyle

Market Insights - September 2023

A periodic newsletter from Idaho Trust Bank

The U.S. equity markets have had an exceptionally strong performance so far this year. The technology sector was by far the best-performing sector group in the first eight months of 2023. These gains have been concentrated in some of the largest companies, particularly those that have exposure to areas related to the emerging area of artificial intelligence.

Artificial Intelligence

The technology sector was hard hit by rising interest rates last year. Many of these firms were firmly in the growth category, relying on cheap money and investor enthusiasm. When yields are low, and money is easy to come by, investors are happier to throw money into audacious projects. For better or worse, this has been especially true in recent years with “technology” firms. When yields rise, however, future cash flows, especially at unprofitable technology startups, are discounted at higher rates, decreasing perceived stock values. The S&P500 information technology sector fell as much as 34.6% since it peaked in late December 2021. However, since a low in October of 2022, the sector has rapidly risen back up to near-all-time highs, primarily driven by investor optimism surrounding artificial intelligence.

Somewhat unlike the rally of the 2010s, the rally so far has been concentrated in the shares of the most highly valued public companies (Microsoft up 40% YTD, Nvidia up 190% YTD, Tesla up 155% YTD, etc.). Microsoft has poured billions into OpenAI (creator of chatGPT). Nvidia is at the forefront of chips used in AI systems and has proprietary predictive video software for their graphics cards. Tesla has its autopilot systems that it hopes will be more fully allowed by regulators in the future. The rapid rally in these huge companies indicates that the market believes that the big firms are best in place to capitalize off of new developments in artificial intelligence.

There are obvious risks to investing directly in some of these firms. Of course, investing heavily in one company introduces risk from being concentrated in one area, but there are other things to consider as well. It could be that the benefits of AI may not be fully realizable in the near term, and big companies will have to write down losses on their investments. There is also the risk of regulation. Artificial intelligence is not perfect and often confidently disseminates false information. Generative AI, which can create new content, may fail to distinguish previous (sometimes false) information it has generated, creating feedback loops where it bases new content off of previous content. Many jobs could be directly at risk due to artificial intelligence. Legislative intervention may be undertaken to stop the displacement of workers and the unintentional spread of misinformation. There are risks surrounding security and privacy as well. AI models can be tricked into misclassifying dangerous inputs as safe and can execute and spread malware (data poisoning). This could be a catastrophic error if it occurred at a company like Google, which holds significant information about the population (addresses, passwords, financials, search history, etc.). It is hard to quantify all of the risks posed by social media during its inception, as it has become subject to more and more regulation over the years. Artificial intelligence will certainly have unintended consequences, likely to be the subject of legislative attention.

Despite these risks, one silver lining is that small/mid-cap stocks may have much room left to grow from artificial intelligence. It is clear that the market does not immediately see how AI can benefit these companies, but several years down the line, it may be easier for smaller firms to adopt said systems for things like customer service, data analysis, or other areas.

Global Inflation

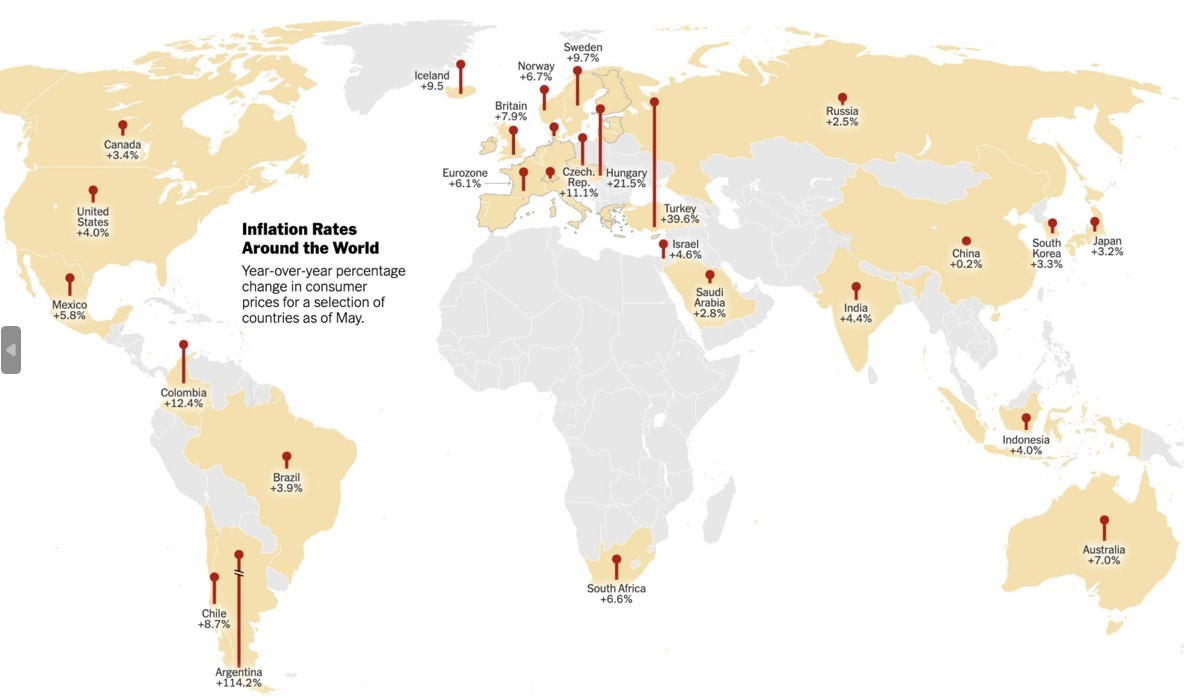

High: Inflation has soared in many emerging markets like Turkey, Argentina, and Lebanon. Emerging markets are particularly vulnerable to currency crises.

Sovereign-denominated debt/bank deposits, undiversified economies, political corruption, and poor monetary and fiscal policies can lead to hyperinflation and spiraling foreign exchange rates.

Medium: The UK has been under significant inflationary pressure; wages continue to rise, and bank withdrawals reached a record level in May. The Eurozone has been facing similar, although less persistent inflation driven by soaring energy and food prices. Eurozone inflation peaked at 10.6% during last October. The European Central Bank raised its interest rate policy to 3.5% in June, the highest in 22 years.

Low: While many countries are facing inflation, China is facing deflation risk. Persistent deflation can pose different risks: loans can become more expensive to pay off, and individuals have the motivation to save instead of spend. These both stifle economic growth.

Conclusion

Although inflation has declined from highly elevated levels, it remains above the Fed’s preferred level. Moreover, there are pockets of inflation around the globe, which remain at high levels. These inflationary pressures could add to concerns that the Fed will further tighten monetary policy in order to rein in inflationary pressures. Therefore, markets could continue to be volatile in the fall. The Federal Reserve has the tough job of reducing inflation without stifling economic growth and causing a recession.

_________________________________________________________