June 2023 Market Insights

Published: 06/15/2023

By: Christopher Coyle

Market Insights

A periodic newsletter from Idaho Trust Bank

Markets have been strong as of late amidst the release of a stronger-than- expected jobs report, as well as news that a debt ceiling agreement had passed in the Senate. The Labor Department revealed that 339,000 jobs were added to the economy, and the unemployment rate rose to 3.7%. The debt ceiling agreement suspends the debt limit until 2025 – but restricts some government spending and ends the freeze on student loan payments. The debt ceiling is often viewed through the lens of political brinksmanship; this time, it was notably close.

The Debt Ceiling

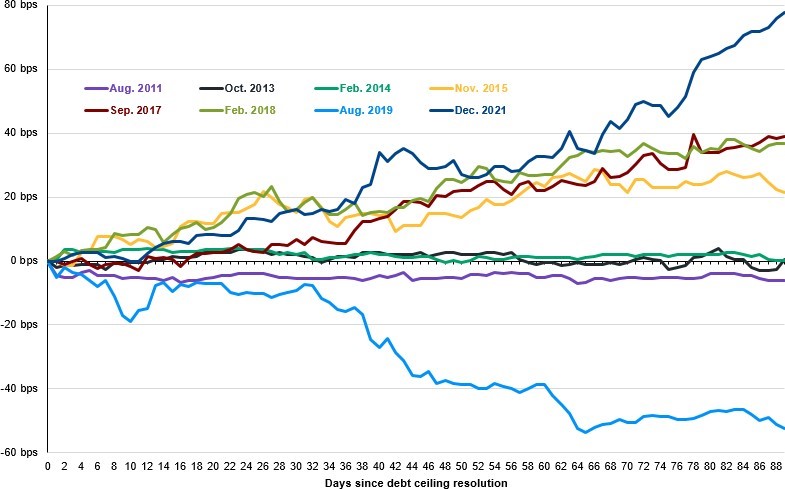

The US Treasury has had to rely on cash in the “Treasury General Account” (TGA) and other extraordinary measures (mainly government pension funds) to make ends meet. Now that the debt ceiling has been suspended until 2025, the Treasury has to refill these coffers. This will include roughly $350 billion to those pension funds, and over $600 billion which it depleted from the TGA. This is important to understand for two reasons. First, increased T-bill issuance to recoup funds to these accounts may put upward pressure on short-term rates. Second, this increased T-bill issuance may decrease liquidity overall in the economy, which may have wider spread impacts. It should be noted that the Federal Reserve has also been engaging in quantitative tightening, another measure to decrease inflation, further putting upward pressure on interest rates. Quantitative tightening is when a central bank commits to either selling treasuries to decrease the money supply or letting securities mature and then removing them from its cash balances (also decreasing the money supply). Recent history shows that there is a decent chance short-term rates will rise after the debt ceiling resolution, having happened several times recently. Combined with a quantitative tightening program and continued interest by the Federal Reserve to continue rate hikes, interest rates may continue to move upwards.

Inflationary Impacts and Rate Increases

Higher interest rates have had many impacts over the last 18 months. Some examples include; investment bank deal flow is down, startups and young companies are having a harder time accessing capital, and publicly traded real estate is down significantly from the highs in late 2021. Commercial real estate has been a particularly sore spot. With many companies still choosing to maintain a remote workforce, and increasing rates decreasing capital expenditures, office REITs like Kilroy Realty and Alexandria Real Estate are down roughly 50% and 27%, respectively, over the last 12-month period. Many office spaces in large cities like San Francisco, Houston, Denver, and Seattle are facing vacancy rates around the 20% mark. Although numerous businesses are trying to get workers to come back into the office, it hasn’t been enough to stop values from falling in certain areas. The Wall Street Journal recently reported that nearly $1.5 trillion in commercial mortgage loans are due over the next three years. Unlike traditional mortgages, commercial mortgages are often interest-only loans, with the entire principal due at the end. This could pose a significant risk, not just to lenders but to commercial real estate values as well.

Technology stocks have experienced a significant comeback in the first half of 2023, with AI in focus. At the time of writing, C3.ai and Nvidia stocks are up 206% and 174% YTD (year-to-date), respectively. VGT, an information technology ETF, is up around 34%. However, technology stocks as a whole are still below their high in December 2021. The SP500 is up around 12% YTD in a recovery concentrated in the largest companies. The S&P500’s return for the year would be negative without the contribution of the seven largest companies in the index. Investors may be piling money into perceived stable companies, or perhaps these companies may be viewed as a way to capitalize off AI technology in the future (Nvidia, Apple, Microsoft, Amazon, Google, Meta, etc.). Comparatively, the Russell 2000 (small cap) and the S&P400 (mid- cap) are up around 3.3% and 2.9%, respectively, so far this year.

The Federal Reserve Bank

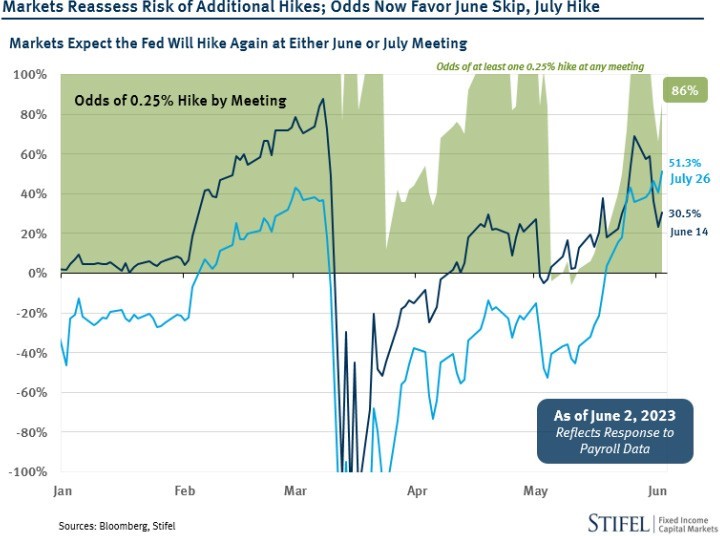

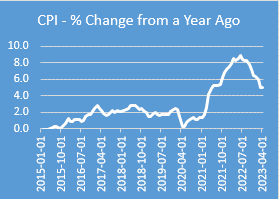

Federal Reserve officials have signaled that they may hold rates steady at their next meeting in mid-June. However, even if rates are held constant, that does not mean that rates will not continue to climb into July and beyond. The Federal Reserve has a dual mandate to manage inflation and employment in the United States. Of course – when more people are employed, there is more inflation as individuals can spend more. The rate of inflation has continued to cool in 2023. This does not mean that there is deflation, but the rate of inflation year over year has decreased from its highs in 2022. Although energy costs and vehicle costs have come down, food costs, hospitality costs, and other service costs have stayed relatively high. Supply chains contributed significantly to inflation in 2021 and 2022 but have “healed” since. Federal Reserve data demonstrates that global supply chain pressures are currently below average.

Despite the decline in inflationary pressures, concerns persist that the Fed will further tighten monetary policy if inflationary pressures remain above optimal levels. The Federal Reserve has the tough job of reducing inflation without stifling economic growth and causing a recession.

_________________________________________________________