Market Insights

A periodic newsletter from Idaho Trust Bank

Despite headlines of doom and gloom during the first quarter of 2023, stock indices at home and abroad recovered from losses last year, and bond yields retreated from recent highs. The big news was, of course, bank failures and regulatory intervention. The collapse of Silicon Valley Bank was the largest bank failure since Washington Mutual in 2008. Overseas, the Swiss government orchestrated a “rescue” acquisition of Credit Suisse, which is now part of UBS. Rising interest rates intended to tame inflation have exposed vulnerability in some bank balance sheets. The question moving forward is: how does this all change the Federal Reserve’s interest rate path?

The Federal Reserve Bank

At its early-March meeting, the Federal Reserve raised interest rates by 25 basis points, bringing the Federal Funds Rate to 4.75-5.00%. This hike surprised some market participants, as the implied interest rate projections from the bond market were well below 25 basis points. On the 22nd of March, Fed Chairman Jerome Powell conceded that the FOMC considered skipping a rate increase after the recent but limited turmoil in the banking sector. The market experienced big intraday moves in March as investors tried to parse what the economic reality will be like in the near future.

There have been some widely publicized stresses in narrow parts of the banking system, but so far, this appears to be contained to a few specific instances. Despite these recent headwinds of higher interest rates, the job market has been resilient, beating expectations of job growth in March. The unemployment rate dropped to 3.5%, and the prime-age participating rate grew to 83.1% (the highest it has been since pre-pandemic 2020). This will give the Federal Reserve more justification for keeping rates high (the Fed has a mandate to: 1) Keep employment high and 2) Maintain price stability). Markets have reacted by pricing in a 70% chance of a rate hike in May. The FOMC will need to consider balancing inflation (which has been falling), and the risks of further rate increases on economic activity.

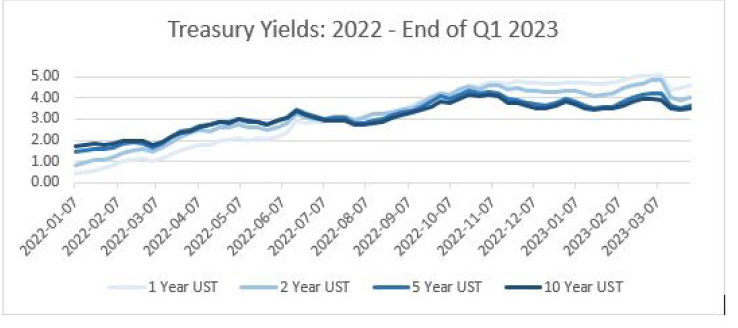

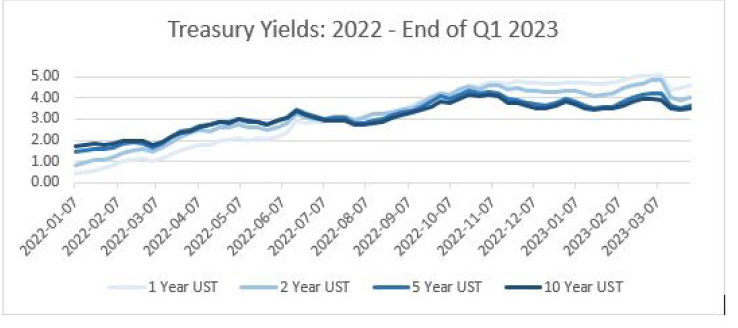

The Federal Reserve (Fed) has not been voicing support behind the idea that rate cuts will occur in late 2023; however, the yield curve remains inverted, suggesting that the market believes that the Fed will have to reverse course sooner rather than later. An inverted yield curve indicates that while market participants expect interest rates to rise, they believe that higher rates will damage the economy to the point where the central bank will have to reverse course and ease monetary policy. This makes long-term bonds more favorable as their higher duration (sensitivity) will allow them to appreciate more during rate cuts. Since these bonds are viewed as more favorable, their yield is pushed down by demand, inverting the yield curve (like we see now). Historically, an inverted yield curve has been a strong predictor of policy (and economic downturn). This does necessarily mean, however, that asset prices will continue to fall. The market is forward-looking. While stocks could continue to fall, it is also possible that the worst is already behind us.

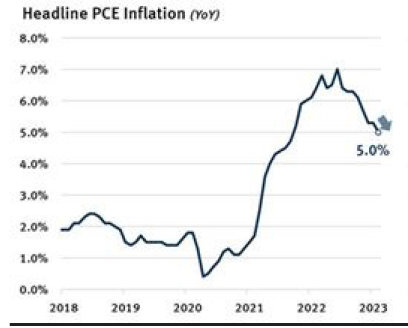

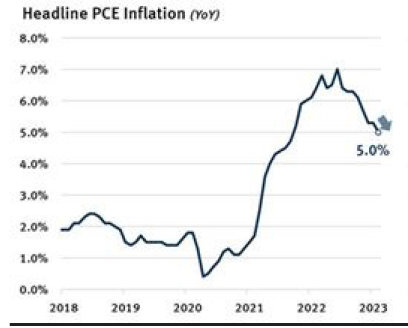

The rate of inflation has fallen in recent months, with energy prices a large contributor to the recent reduction in inflation levels. However, earlier in April, OPEC announced that it would be cutting crude oil production. Despite this, energy futures have been relatively calm (around a 6% bump after the announcement and retreating since) and at price levels far below mid-2022. Additionally, increased workforce participation has moderated wage growth which rapidly advanced in late 2021 and 2022. While employment is a positive force on inflation, moderating wages and a more employed supply chain may do more good than harm to price levels overall.

First-Quarter Review

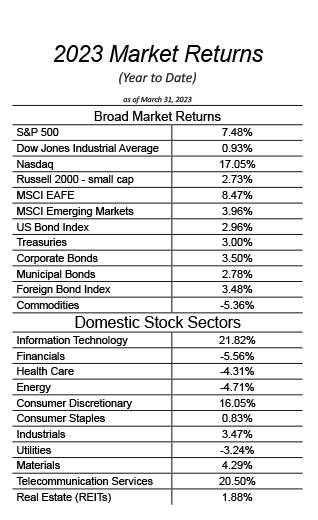

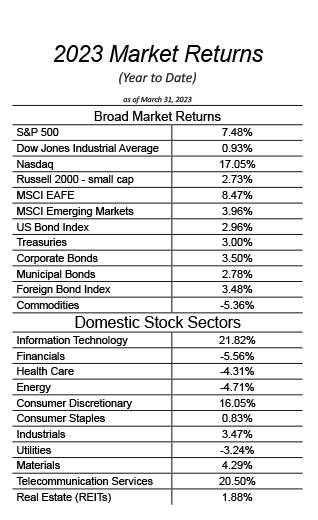

Most equity markets experienced a solid rebound in the first quarter of 2023. While broad indices SP500 (US) and the EAFE (developed international) rose steadily at 7.48% and 8.47%, respectively, technology stocks advanced at an even faster pace. The SP500 information technology index rose 21.82%, and the tech-heavy NASDAQ rose 17.05%. Generally speaking, recent history has seen tech-focused companies grow and fall more dramatically than the broader index. However, recent gains in tech have not been able to offset their greater losses versus the broader index over a 2 year period.

Conclusion

The first quarter of 2023 has been a volatile one, and it may continue in the near future. The market will be closely watching for indications on future Fed policy and earnings calls in the coming week or so. Stocks have still been up across the board over the last few months, and portfolios will benefit from heightened fixed-income yields.

_________________________________________________________

1. Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/ dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes.

2. Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000.

3. Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank.

4. Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice.

5. Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest.

6. Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results.

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest.

Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable but is not guaranteed. Any opinions expressed are based on our interpretation of data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice.

NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE

Rev. 4.30.23 ©Idaho Trust Bank, 2023. All Rights Reserved.