March 2023 Market Insights

Published: 03/31/2023

By: Christopher Coyle, Chief Investment Officer

Market Insights

A periodic newsletter from Idaho Trust Bank

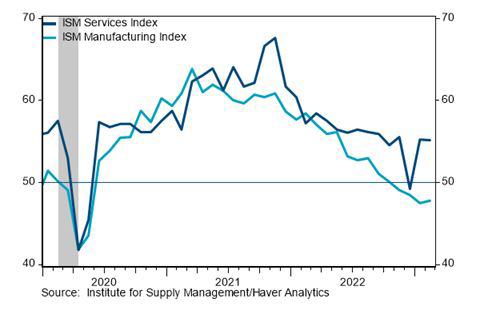

Economic Activity

Recent economic data has been somewhat confusing and paints a mixed picture of the domestic economy. The Commerce Department reported that the U.S. economy grew, in real terms, at an annualized rate of 2.7% in the fourth quarter of 2022. That represents a deceleration from a 3.2% increase in the prior quarter (3Q). Despite this slowdown, inflation pressures remain strong. The Personal Consumption Price index, the Federal Reserve preferred inflation measurement, rose 0.6% in January (the most recent measure), which means inflation accelerated from a 0.2% increase in December. The core PCE rate, which excludes volatile food and energy, rose by 0.6% in January.

The labor market continues to be very strong. The last jobs report showed an unemployment rate of 3.4%, the lowest level in over 50 years. Labor force participation has improved, but only by a small amount. Initial jobless claims are down to 192,000.

Housing, on the other hand, has experienced a meaningful slowdown. The Census Bureau said that new single-family home sales came in at an annualized rate of 670,000 (down 19% from a year ago). Over the last year, the average home price is down 5.3%, but the median price is down just 0.7%. That suggests that the higher-priced homes are declining at a faster pace.

Durable goods orders fell by 4.5%, but that drop was almost all due to Boeing. In December, Boeing got a surge in orders, which led to a slow January. Airplane orders can be very volatile. If we exclude transportation, then orders were up by 0.7%. More important, business investment climbed 0.8% to mark the fastest gain since last August. Investment had declined in three of the last four months of 2022. Still, the annual rate of growth in business investment slowed again to 4.3% from 5% — less than half the pace compared with one year ago. These orders exclude military spending and the auto and aerospace industries.

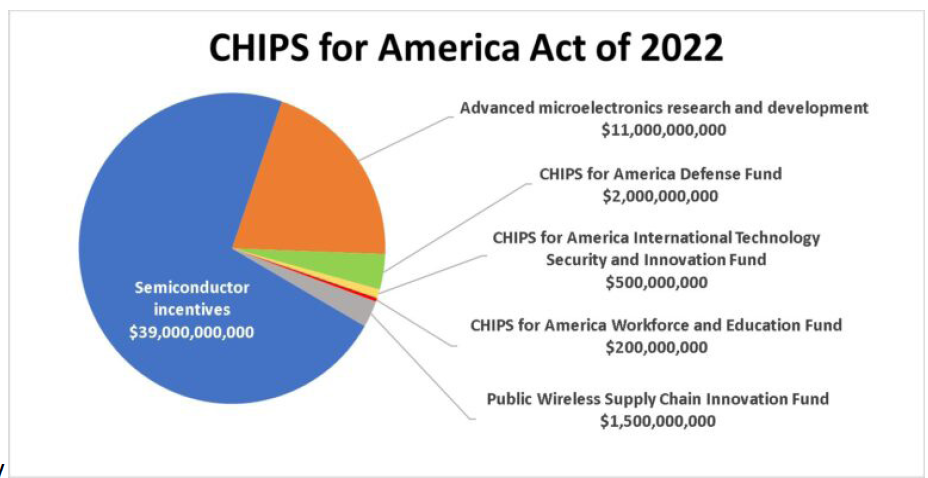

CHIPS Act

Today, the United States purchases more than 90% of its advanced computer processing chips from Taiwan. Looking ahead, that is a big problem. It is no secret that China has been flexing its might over Taiwan, and Taiwan’s long-term self-sovereignty is in limbo. This was part of the justification for passing the Chips Act, a $53 billion fiscal spending package aimed at invigorating the domestic semiconductor industry. While the Chips Act was signed into law last year, applications for subsidies contained within the act only opened at the end of this past February.

There are a number of restrictions that come along with these subsidies, with dividends and stock buyback restrictions being at the forefront. While investors may look at this fiscal spending with the hopes that it can rocket share prices back to the highs seen in late 2021, there is reason to exercise patience. Manufacturing semiconductors is a massively capital-intensive process, and it takes a long time to produce fabrication plants. Additionally, even though there are many American semiconductor companies (Nvidia, Qualcomm, AMD, Intel, etc.), these companies outsource a significant amount of production to TSMC in Taiwan. Even with subsidies, the capability to produce semiconductors at home will take a long time.

Micron, one of the world’s largest semiconductor firms (and the only US manufacturer of computer memory), announced that it would invest approximately $15 billion into memory manufacturing capital in Boise by 2030. Micron estimates that this investment will create 17,000 jobs in Idaho and 2000 direct jobs at Micron once everything is fully built. However, this could take many more years to come to fruition – especially apparent after Micron announced that in 2023 it would lay off around 15% of its employees.

Intel is another big semiconductor firm also planning to change course in the midst of the Chips Act. Similar to Micron, they have been going through layoffs, pay cuts, cost reductions, and reducing their dividend by 2/3. Since mid-2021, Intel has shed more than half of its value. But in the long-term, there may be significant upside for Intel as they plan huge multi-billion dollar investments to create semiconductors back in the United States.

While the semiconductor industry is notoriously cyclical and was hit hard during the 2022 market downturn, perhaps with a long-term focus and generous incentives to produce and innovate, the environment could be considerably different in 7-10 years. However, large risks remain. The US is not the only big player emphasizing semiconductors. Japan, the EU, South Korea, Canada, India, and China all have their own incentives for chip production. When many countries pursue the same industrial goals, it is harder for any one country to succeed. With so much money pouring into the semiconductor industry, a glut could also materialize. In either case, chip production, security, and supply chain shortages have been at the forefront of the economic conversation for the last several years now. It is unlikely that will change in the near future.

Conclusion

Given the large number of unknowns surrounding inflation, it is likely that volatility levels will remain high going into the spring and possibly the summer. Inflationary pressures have forced the Fed to tighten monetary policy in order to rein in inflationary pressures. This shift has contributed to the market volatility, which is likely to continue in the near term. The Federal Reserve has the tough job of reducing inflation without stifling economic growth and causing a recession.

_________________________________________________________