January 2023 Market Insights

Published: 01/31/2023

By: Christopher Coyle

The Federal Reserve Bank

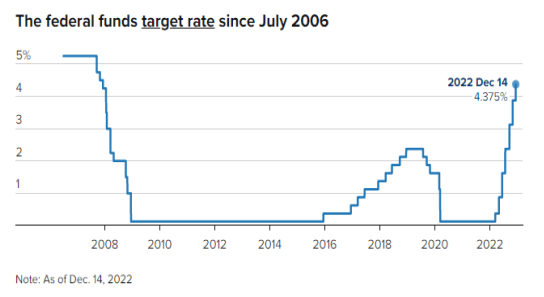

At its mid-December meeting, the Federal Reserve Bank (Fed) raised interest rates for the seventh time in 2022. The target range of the Fed funds is now 4.25% – 4.50%. The most recent increase raised the benchmark rate by 50 basis points, which was slightly lower than the past four meetings when rates were raised by 75 basis points at each meeting. Inflation levels remain significantly higher than the Fed’s target level. The Fed members have indicated that they expect to keep rates at elevated levels for a while until inflation levels decline to more tenable levels. Market observers expect that the Fed will increase rates two more times in the first quarter of 2023. The Fed’s policy position represents a very aggressive stance, but many are hopeful that recent inflation data has begun to demonstrate some reductions in monthly rates, albeit from a very high level. The new Fed Funds level marks the highest level since December 2007, shortly before the Great Financial Crisis (see graph). The Federal Open Market Committee (FOMC) lowered its economic growth expectations for 2023, with a modest 0.5% increase in Gross Domestic Product (GDP). The Fed is also in the process of reducing the size of its balance sheet, which had grown to nearly $9 trillion. The first step in this process is to let bonds mature without replacement. According to the central bank’s estimates, this ‘roll-off’ process will be about $95 billion per month, which has resulted in a $332 billion decline since this process began in June.

Year-end Review

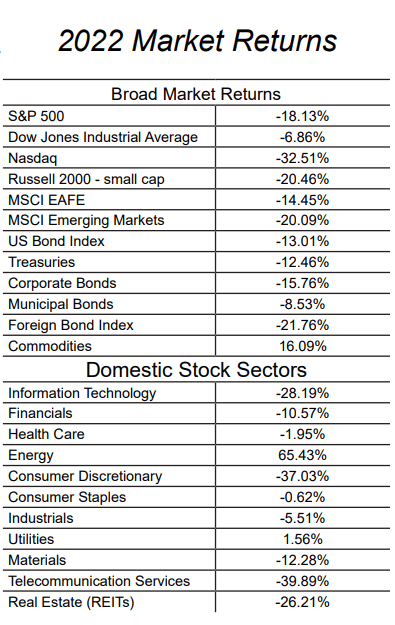

The U.S. indices experienced widespread equity market losses in 2022. The S&P 500 index fell 18.13%, including dividends last year. It should be noted that the index rose 28.68% in 2021. Many factors likely contributed to this poor performance last year, but most importantly was the inflationary pressures that resulted from the strong economic rebound following the Covid-related shutdown. While economic activity has been strong overall, there have been bottleneck and shipping issues that have hampered activity levels. These issues have in some instances, delayed production or caused higher input costs due to supply shortages and higher transportation expenses. Adding to the inflationary pressure is an extremely tight labor market, which is putting upward pressure on wages, adding to the Fed’s concern about additional inflation pressures. Overseas equities also experienced poor returns. The developed markets declined slightly less than most other major markets, falling 14.45%, as the rebound inactivity has not been as strong as it has been domestically. Emerging Market stocks lagged, registering a decline of 20.09%, which was in line with the decline in domestic small-cap indices. Chinese markets struggled from a restrictive economic shutdown due to an aggressive Covid policy response toward the end of the year. The Nasdaq Composite, which contains a large portion of technology companies, experienced some of the sharpest declines of most major markets. The index fell 32.51%, which was the result of activity levels that shifted away from Covid related spending toward other areas. Additionally, the increase in interest rates hurt technology stocks that traditionally sell at higher valuation levels. Commodities and energy stocks experienced sharp gains, as the stocks in these areas sharply rebounded from the weak returns in prior years. The energy sector was the best-performing area last year (as was the case in 2021).

Conclusion

Given the large number of unknowns surrounding inflation levels, it is likely that volatility levels will remain high in the first half of this year. Therefore, markets could continue to be volatile in the near term. However, we believe that the long-term investment outlook remains solid with a healthy economic backdrop as well as higher rates which should benefit fixed-income returns going forward.

- Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/ dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes.

-

Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000.

-

Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank.

-

Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice.

-

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks, including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High-yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest.

-

Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results.

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment-grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest.

Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable but is not guaranteed. Any opinions expressed are based on our interpretation of data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice.

NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE

Rev. 12.31.2022 ©Idaho Trust Bank, 2022. All Rights Reserved.