March 2022 Market Insights

Published: 03/15/2022

By: Chris Coyle, Jack Carpenter

Market Insights

A periodic newsletter from Idaho Trust Bank

Eurozone

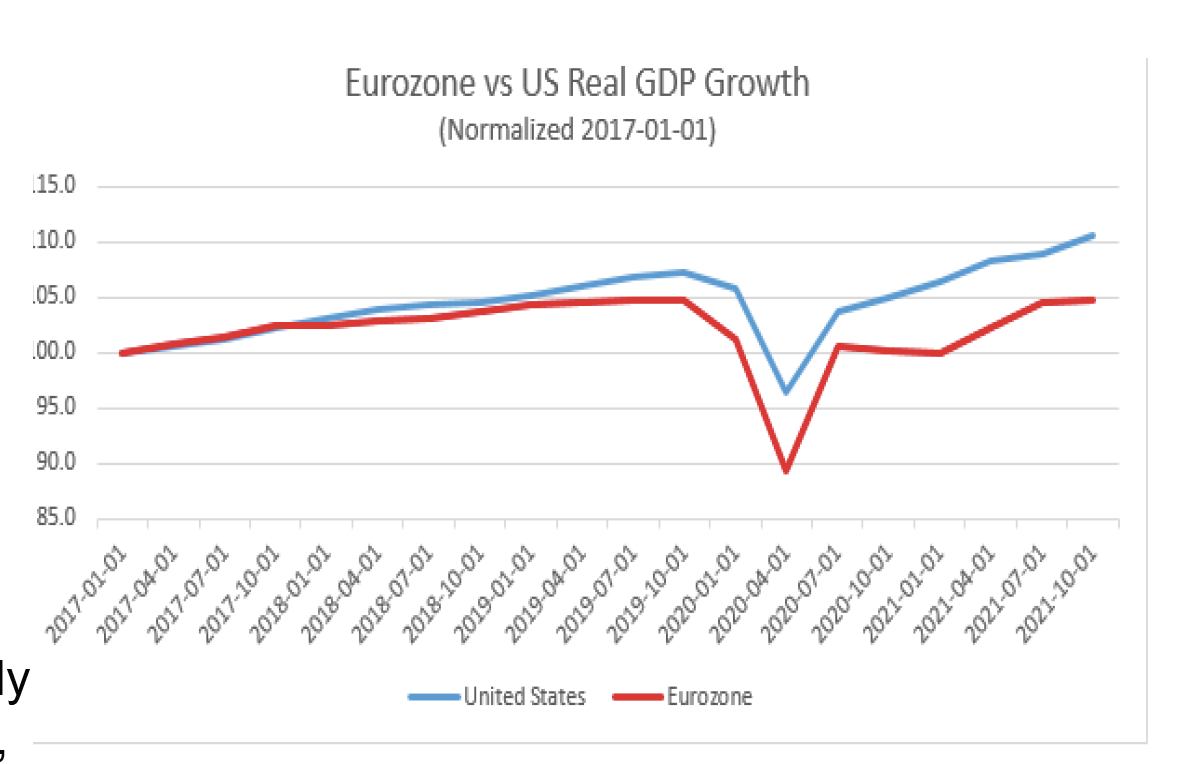

The economic landscape in Europe has not quite fully recovered to the pre-pandemic levels of late 2019 and early 2020. Europe has largely faced similar issues to those of the United States, such as supply chain disruptions, elevated prices of materials (particularly in semiconductors and energy), labor shortages, and inflation rates above normal levels. In some cases, pension policies have contributed to labor shortages. This is an especially challenging issue in Europe’s largest economy, Germany, where economists are predicting that their workforce could shrink by around five million individuals by 2030. Due to these bleak undertones, the European central bank is likely to maintain a more accommodative monetary policy than many other major central banks around the globe, as the Eurozone recovery has lagged that of the United States (see chart below). Additionally, developed international equities have more attractive equity valuations compared to many domestic indices.

Emerging Markets

Emerging market regions face many challenges in getting their economic activity back to pre-pandemic levels. Many nations still lack adequate access to vaccinations and other medical resources needed to combat Covid-19. Asian shipping/manufacturing industries are particularly

vulnerable to outbreaks, as we have witnessed in recent months. This added volatility is on top of the array of already existing political, economic, and currency headwinds.

While these risks are nothing new, added factors contributing to volatility further emphasize the need to maintain portfolio diversity, and a long-term outlook on these equity markets. Despite all the risks surrounding emerging markets, the case for investing in emerging equities is as clear as ever: the vast majority of the world’s young population live in emerging markets, with potential for higher corporate profits, productivity, and GDP growth. This is contrasted by rapidly aging populations in developed economies around the world, which are already struggling to fill all jobs.

China

It is hard to paint the full picture of international markets without taking a look at China. Chinese equities make up a significant proportion of any emerging market index - and for good reason: they make up much of the developing world.

China experienced several economic challenges last year. GDP was strong in the first half of the year but slowed down significantly in the second half. Regulatory crackdowns on private tutoring and technology caused massive selloffs amongst ensuing anxiety from investors, the collapse of property giant Evergrande sent shockwaves through bond and real estate markets, and domestic consumption fell consequently. Investors must seriously consider further issues in the coming years as well. The United States is considering adding further regulations to investing in China, China’s population growth is starting to fall (the difference between births and deaths is starting to shrink), and President Xi Jinping is expected to seek an unprecedented third term in power.

Chinese policymakers are eager to get the economy back on a stronger footing. They recently decreased their required reserve ratio for banks as well as their interest rates, indicating they want to further accommodate monetary policy to help clean up the real estate market.

Ukraine and Russia

Markets across the world have their eyes on the tragic conflict between Russia and Ukraine, the first mainland conflict in Europe since World War II. Undoubtedly this has raised significant questions about investing in emerging markets, as well as commodity prices (particularly grains and oil). While we want to acknowledge the devastating impacts of this war on the Ukrainian people, investors may be curious about the links between major geopolitical events and performance in financial markets.

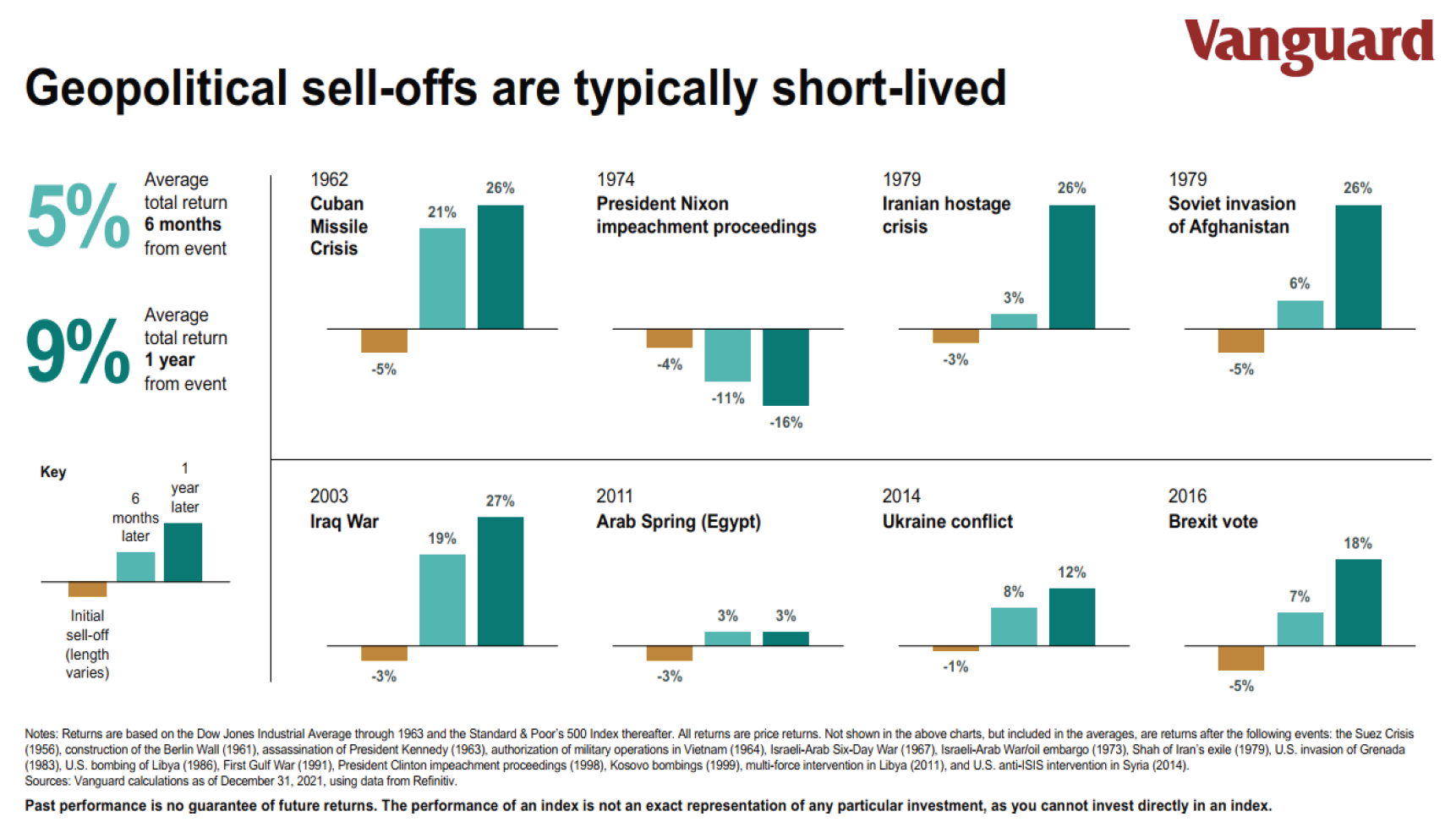

While geopolitical conflicts can shock financial markets in the short term, historically speaking, markets have bounced back relatively quickly. There is the idea that “time in the market beats timing the market” and the past few weeks demonstrate that. Periods of sharp losses are often closely followed by periods of sharp gain. This makes “timing the market” exceptionally difficult.

Consider this chart below: which reviews equity market performance before and after several significant geopolitical events, beginning with the Cuban Missile Crisis in 1962.

Conclusion

While these historical conflicts have had widespread consequences across the world, markets have tended to rebound. Given the high level of uncertainties, it is wise to maintain a highly diversified investment portfolio to protect from these shocks that are nearly impossible to predict.

---

- Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes.

- 2. Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000.

- 3. Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank.

- 4. Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice.

- 5. Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may in-clude higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No represen-tation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest.

- 6. Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results.

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested invest-ment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable, but is not guaranteed. Any opinions expressed are based on our interpretation of data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice. NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE Rev. 2.28.22 ©Idaho Trust Bank, 2022. All Rights Reserved.