January 2022 Market Insights

Published: 01/13/2022

By: Chris Coyle

Market Insights: A periodic newsletter from Idaho Trust Bank

Domestic stock indices had a very strong year in 2021. As the economy has improved, interest rates have begun to move up, which has hurt the performance of many fixed-income investments. Some regions have experienced an uptick in Coronavirus cases but the economic impact has been muted so far. However, the direction of future monetary policy has emerged as a major concern. These worries have increased uncertainty and added to volatility in recent weeks.

The Federal Reserve Bank

A substantial improvement in the labor market and persistent inflationary

pressures, drove the Federal Reserve Bank (Fed) to shift its monetary policy outlook. At its mid-December meeting, the Federal Open Market Committee (FOMC) voted to maintain the current Fed funds target rate at a range of 0.00%–0.25% but also double the pace of reduction of its monthly asset purchases from $15 billion, to $30 billion. Assuming the committee continues to reduce purchases at this rate, its balance sheet expansion will be concluded by March.

The Fed Statement included new language that noted “the unemployment rate has declined substantially,” while the Summary of Economic Projections highlighted the tighter labor conditions. Inflation was no longer characterized as being “transitory” in the Official Statement and the reference to inflation “persistently below [the] longer-run goal” of 2.0% was removed. This suggests that inflation levels have become more of a concern than had been the case a few months back, and acknowledges that inflation is expected to be more persistent in 2022.

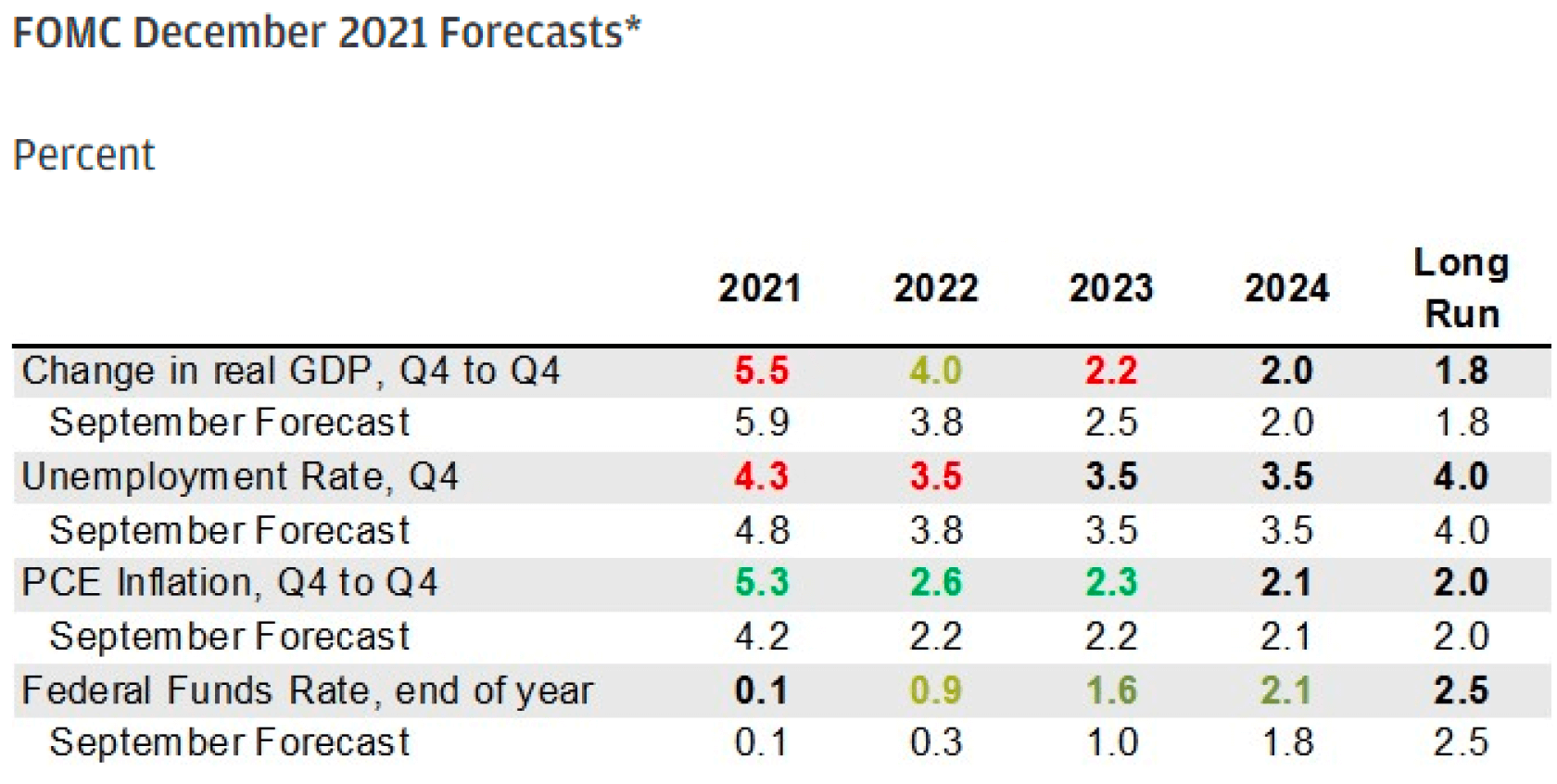

The Fed was clear that high inflation and falling unemployment prompted the committee to hasten its tapering timeline. While it acknowledged the uncertainty on the economic outlook due to new COVID-19 variants, the combination of persistent supply chain pressures pushing prices higher and incredibly strong demand for labor outweigh the risks of maintaining the prior monetary policy. The Fed lowered its 2021 GDP forecast to 5.5% (from 5.9%), partially reflecting the 3Q21 slowdown driven by the delta variant. However, it lifted its 2022 GDP estimate by 0.2%, to 4.0%.

The Fed now expects three interest rate increases this year and an additional three in 2023. This represents a stark shift from its September forecasts which only called for one hike in 2022. All told, the Fed’s view that the economy has made significant progress towards its goals and the receding pandemic effects –notwithstanding omicron— has allowed for an accelerated pace of asset tapering as well as interest rate increases.

Year-end Review

The U.S. indices experienced very strong equity market gains in 2021. The S&P 500 index rose 28.68%, including dividends last year. Many factors likely contributed to these exceptional results, but most importantly the strong economic rebound following the Covid-related shutdown, which helped to generate strong corporate profits. While economic activity has been strong overall, there have been bottleneck and shipping issues that have hampered activity levels. These issues have in some instances delayed production or caused higher input costs due to supply shortages and higher transportation expenses. Additionally, in the final quarter of the year, an uptick in Covid cases forced temporary restrictions in some regions, affecting productivity.

Of the major U.S. indices, small-Cap equities started the year very strong but lost some momentum by the second quarter, still 2021 Market Returns registering a strong 14.78% gain for the year. Overseas equities lagged domestic equities last year. The developed markets experienced decent returns (up 11.26%), as the rebound inactivity has been not as strong as it has been domestically. Market stocks were notable laggards and registered a modest decline for the year as a regulatory crackdown on several industries in the Chinese markets as well as the default of a major real-estate development firm that has stoked concern on the health of the real estate market in China. The Nasdaq Composite, which contains a large portion of technology companies, experienced gains slightly below the more diversified S&P 500 index. Commodities and energy stocks experienced sharp gains, as the stocks in these areas sharply rebounded from the weak returns in prior years. The energy sector was the best performing area last year.

Conclusion

Given the large number of unknowns surrounding coronavirus, it is likely that volatility levels will remain high going into the spring. Inflationary pressures could add to concerns that the Fed will further tighten monetary policy. Therefore, markets could continue to be volatile in the near term. However, we believe that the long-term investment outlook remains solid with a healthy economic backdrop.

-

Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes. 2. Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000. 3. Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank. 4. Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice. 5. Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate

in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may in-clude higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No represen-tation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest. 6. Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results.

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested invest-ment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable, but is not guaranteed. Any opinions expressed are based on our interpretation of data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice. NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE Rev. 12.31.2021 ©Idaho Trust Bank, 2021. All Rights Reserved.