December 2021 Market Insights

Published: 12/13/2021

By: Jack Carpenter, Chris Coyle

December 2021 Market Insights

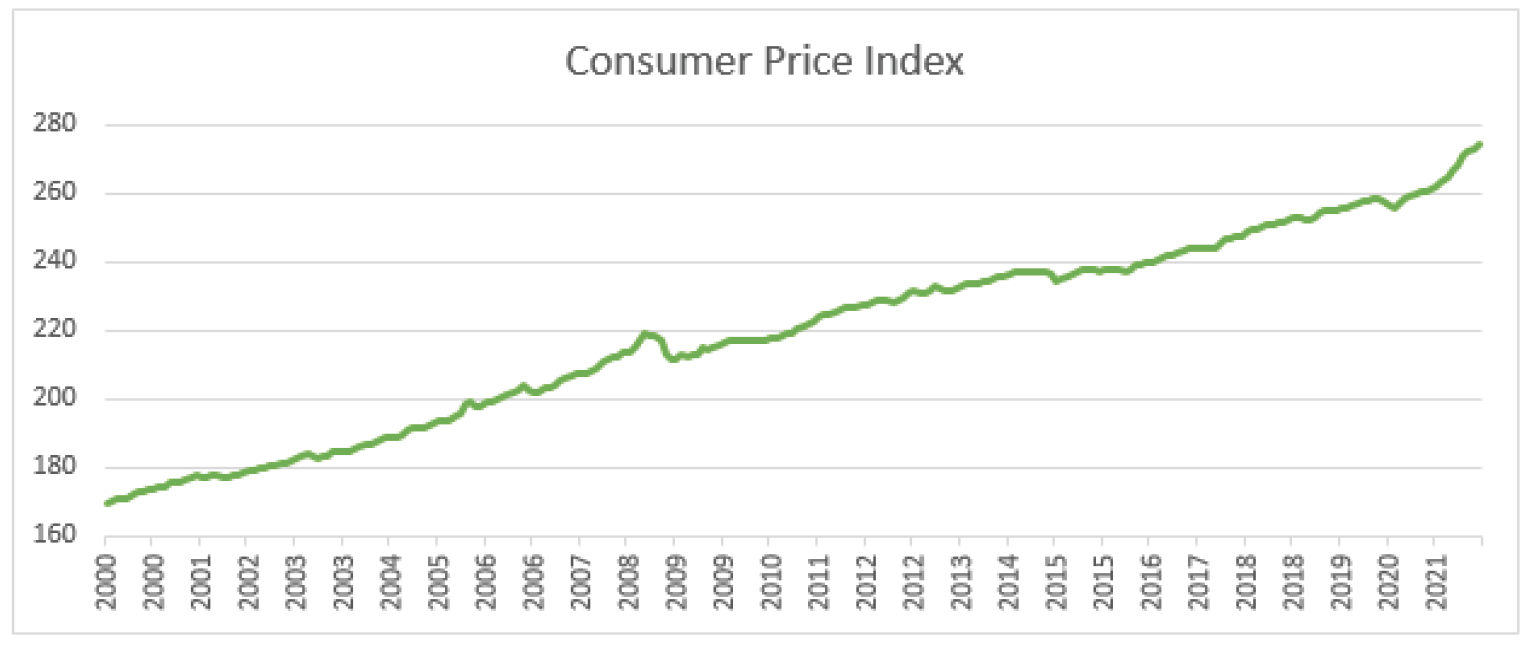

Major stock indices have experienced strong returns so far this year. A sharp increase in economic activity has created supply chain issues and some labor shortages, among other issues. These challenges have helped push costs high, which has created concerns that inflation levels will run at higher levels than has been the case in recent memory. At this point, there remains a fair amount of uncertainty about how long these elevated inflationary issues will remain.

Inflation, The Federal Reserve, and National Shortages

Inflation concerns have dominated headlines over the past few months. High inflation readings have emerged in recent economic statistics. There is not a single reason as to why inflation has increased but rather multiple factors that are likely contributing to this new environment. We have outlined two economic perspectives below which should help provide some insight into these issues.

Demand Side Perspective:

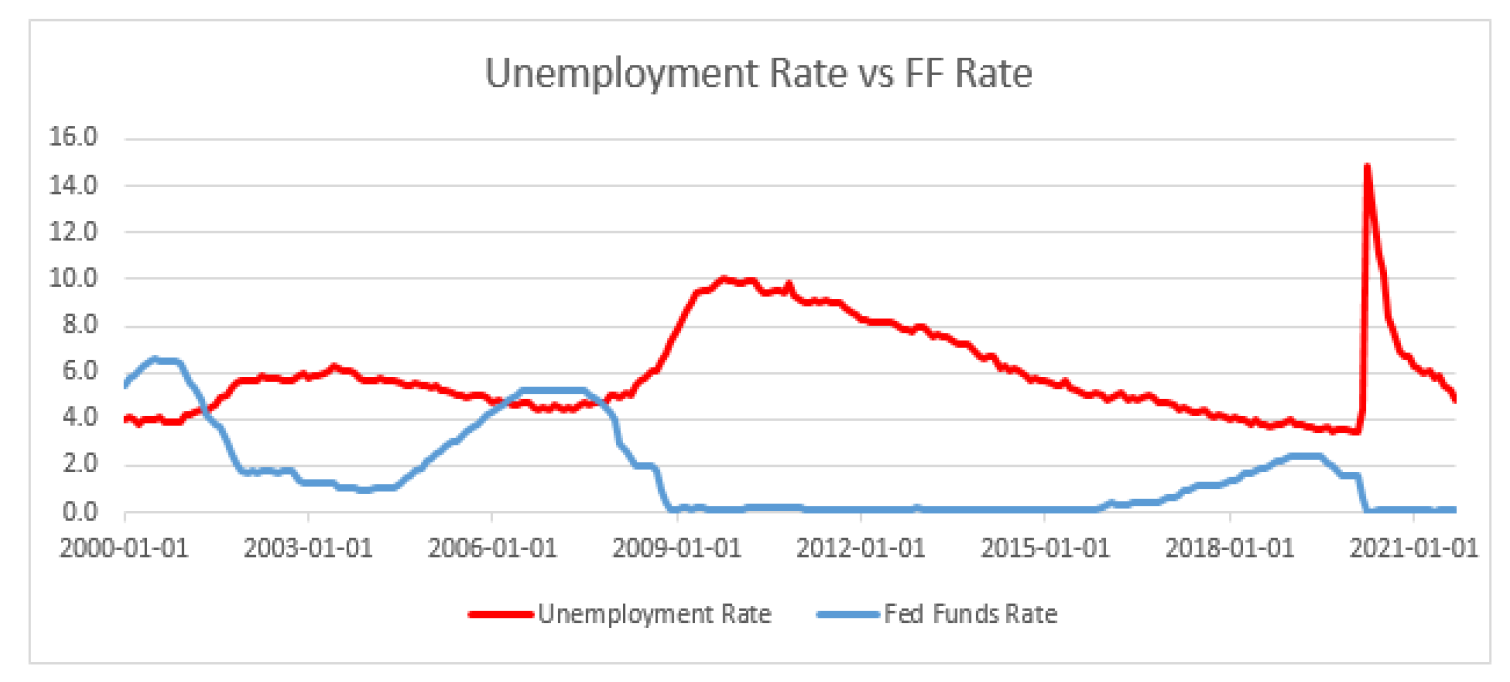

The Federal Reserve has three key goals: keep unemployment rates low, maintain target inflation (about 2% per year), and hold long-term interest rates steady (in that order). These three factors are not mutually exclusive and policies that are undertaken and directed to impact one area, typically affect other areas. For example, consider unemployment and interest rates:

Generally speaking, when unemployment levels rise, the Federal Reserve Bank (Fed) will decrease interest rates, in order to stimulate the economy. The idea is that when interest rates are lowered, it allows companies to more easily borrow money to expand their business and hire more workers, which in theory helps to lower unemployment levels. While not every economic cycle is similar, this process has normally worked as expected. Unfortunately, another consequence of this monetary stimulus is that economic activity helps to stoke costs/inflation, which helps push long-term interest rates higher.

While decreasing short-term interest rates through the Federal Funds lending can help to boost employment levels, this likely adds to inflationary pressures. This is in part why inflationary pressures are blamed on the actions of the Fed. As the economy exited the most recent recession

(caused by the COVID-19 related shutdowns), activity levels have accelerated at a much faster pace than had been anticipated. These stronger demands have incentivized companies to increase hiring. But this new demand for workers has pushed up employment costs. These economic dynamics help to explain part of the recent inflationary pressures.

Supply Side Perspective:

According to manufacturers, demand is strong, and supply is weak. These undercurrents have been felt in many important industries with vast exposures in everything from semiconductors to lumber. Naturally, this has helped drive up prices, as demand remained strong.

The pandemic had many impacts on the labor market, likely accelerating some shifts that may have already been taking place. The number of workers that left the workforce was well above prior levels, in fact, many chose to retire before the traditional age, likely helped by strong returns in the stock market over the past decade. Other workers have delayed their return to the workforce for many reasons. These labor shortages have opened opportunities for others to shift careers, which has left many entry-level and low-wage jobs vacant. Once again, to fill these openings, companies have been forced to raise wages in these roles. Higher wages have helped drive consumer demand, thereby further raisings expenses for the goods/services. This has led some states to look at ways to expand the labor force, such as reducing the minimum age to start work.

The U.S. relies on China as a primary source of processing microchips for all sorts of applications from technology to appliances. Unfortunately, China is having challenges getting its production activity to pre-pandemic levels. There are supply chain issues as well as recent power shortages which have contributed to a slowdown in production. In order to reduce our dependence on Asian manufacturing, many politicians and business leaders have cited a need to expand our domestic semiconductor production, along with other important industries. Bringing back production would reverse the long-term trend of companies ‘offshoring’ their manufacturing activities. This could be very beneficial to domestic economic activity in the coming years.

Lastly, global shipping markets have experienced significant slowdowns in throughput since the summer months. Strict COVID-19 regulations in China, Vietnam, and elsewhere in Asia, have severely limited the capacity to move goods across the world. Additionally, there is a vast shortage of available shipping containers. These containers travel the globe, but currently many are stuck in North American ports, causing even more turmoil amongst Chinese shipping companies. Without these containers, goods cannot be moved from production facilities to the end-users.

The Bottom Line:

Whether or not you’re inclined to believe inflationary pressures stem from mistakes by The Federal Reserve, from global supply shortages, or a combination of the two, there is a light at the end of the tunnel. The Federal Reserve has begun tapering bond purchases, which suggests that the Fed believes that economic activity is strong enough and does not require as much support. Supply chain challenges are being addressed, which has allowed production levels to ramp up, alleviating some of the recent pricing pressures and boosting product availability. While inflation is currently running above the Fed’s target rate of 2%, several indicators suggest that rates may be coming down next year.

Peace of mind and access to funds that’s always there when you really need it. Open an iExpress Line of Credit today!

-----

Disclosures:

- Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes.

- Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000.

- Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank.

- Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice.

- Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate

in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may in-clude higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No represen-tation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest. - Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results. Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested invest-ment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable, but is not guaranteed. Any opinions expressed are based on our interpretation of data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice. NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE Rev. 11.30.21 ©Idaho Trust Bank, 2020. All Rights Reserved.