October Market Insights

Published: 10/08/2021

By: Christopher M. Coyle, CFA

October 2021 Market Insights:

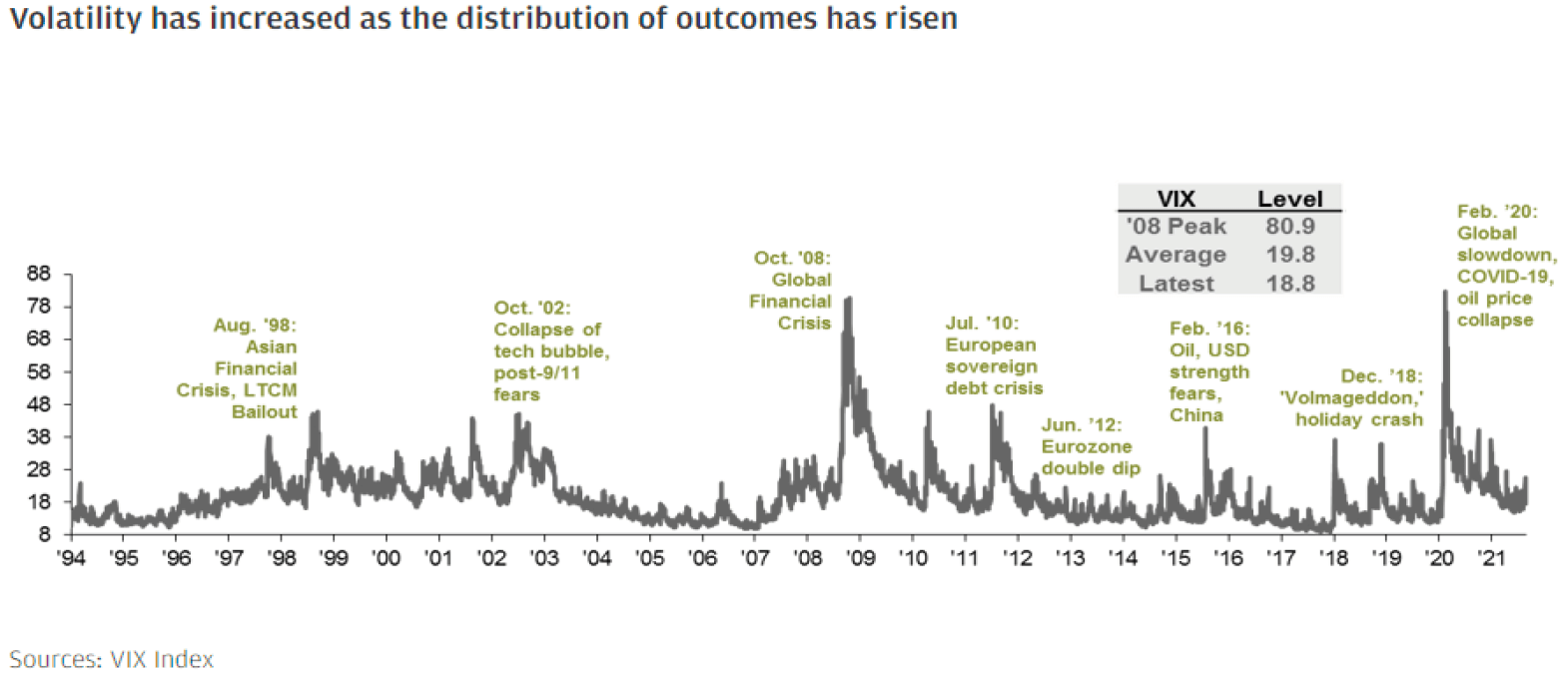

Major stock indices have had a strong year so far. As the economy has improved, interest rates have begun to move up, which has hurt the performance of many fixed-income investments. Some regions have experienced an uptick in Coronavirus cases but there has not been an economic impact as of yet. However, several new concerns have emerged, such as the debt ceiling, an infrastructure bill, and the direction of future monetary policy. These worries have increased uncertainty and added to volatility in recent weeks.

The Debt Ceiling

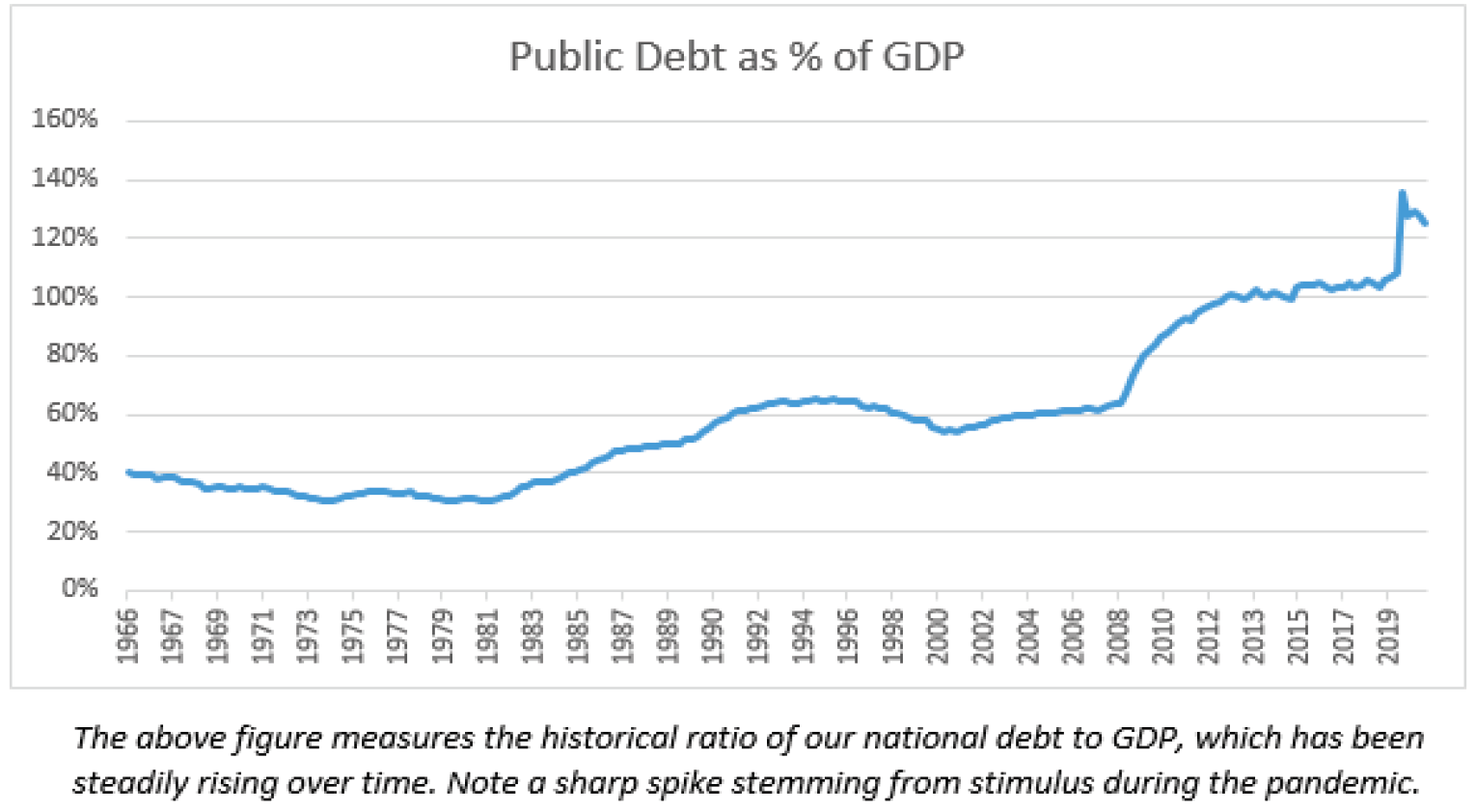

In 1917, the U.S. debt ceiling was created under the Second Liberty Bond Act. It introduced a maximum amount of money that the U.S. could borrow through issuing bonds. Since then, the U.S. Government has bumped up against that limit numerous times and government officials have raised the debt ceiling many times. The mechanics of implementing these changes have become political theater as different political groups use the negations to push their political agendas. There have been several instances where the government shut down due to debt ceiling negations. Recently, Treasury Secretary, Janet Yellen announced that the U.S. Treasury was taking measures to raise cash amongst fears that we will soon hit the debt ceiling once again.

In Washington, there is conflict over raising the debt ceiling. This is typically a partisan battle. To raise the debt limit Congress needs a supermajority of 60 votes. It isn’t totally clear what will happen this time, but we have raised the debt limit many times in the past. If the debt limit is not raised, the U.S. could suspend some pension payments, as well as the pay of federal workers. We have gotten very close to this point in the past. In 2011 Standard & Poor’s stripped the U.S. of its AAA credit rating, as it came within days of not being able to make certain benefit payments.

According to the Treasury Secretary, if the debt ceiling is not raised, it would likely cause sharp growth in interest rates, federal job losses, and a potential recession. It will likely be a big talking point in the national news in the coming weeks. Speculation over what may happen could create volatility in the coming weeks, with no clear outcome in sight as of yet.

Year-to-Date Recap

So far this year, the domestic equity markets have experienced solid returns due in part to the recovery following the Covid-related shutdown. While economic activity has been strong overall, there have been bottleneck and shipping issues that have hampered activity levels. These issues have in some instances delayed production or caused higher input costs due to supply shortages or higher transportation expenses. An uptick in Covid cases has caused temporary restrictions in some regions, affecting productivity.

Performance in overseas markets has been a bit more mixed. The developed markets have experienced decent returns (up 8.35%), as the rebound Broad Market Returns inactivity has been not as strong as it has been domestically. Emerging markets have experienced a modest loss for the first nine months of this year. The decline has been primarily driven by a regulatory crackdown on several industries in the Chinese markets as well as the default of a major real-estate development firm that has stoked concern on the health of the real estate market in China.

Interestingly, the strongest domestic sector has been energy, which has advanced 43% so far this year. Financials have experienced a gain of 29%. Energy has likely benefited by a rebound in travel-related activity as well as demand from transportation services. Compared to the same period in the prior year, energy was the weakest performing group, down almost 34%.

Conclusion

The economic recovery has been uneven, as the return to ‘normal’ has not been smooth. These bumps have caused delays, which along with strong demand and price pressures, has caused an uptick in inflation. Although there has not been any significant change, these inflationary pressures could have an impact on Fed policy. We believe that the long-term outlook has improved with a stronger economic picture for the remainder of the year and into the next. However, given the large number of unknowns surrounding coronavirus as well as the debt ceiling and Fed policy, it is likely that volatility levels will remain high this fall and into the winter.

Idaho Trust Bank offers total wealth solutions including its LifeNeeds™ investing process. LifeNeeds™ utilizes proven strategies and techniques delivered by a highly trained staff of wealth management professionals.

———

Disclosures:

1. Consult an Idaho Trust Bank financial consultant for more details. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIP. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Investment accounts generally under $300,000; Insurance and Annuities of all sizes.

2. Please see the Idaho Trust Bank Schedule for Fees. Investment accounts generally over $300,000.

3. Please see the Idaho Trust Bank Schedule of Fees. Investment accounts generally over $500,000. Certain products may be provided by a Financial Consultant of Idaho Trust Financial is utilized: (1) Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC; (2) Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial; and, (3) Idaho Trust Bank is a separate company from LPL Financial, Idaho Trust Bank does not provide tax or legal advice. Overlay Asset Management utilizes external and/or internal managers selected by Idaho Trust Bank.

4. Certain products may be provided by a Financial Consultant of Idaho Trust Financial. Securities and insurance products are offered through LPL Financial and its affiliates, Member FINRA/SIPC. Idaho Trust Bank is not a registered broker/dealer and has a brokerage affiliate arrangement with LPL Financial. Idaho Trust Bank is a separate company from LPL Financial. Idaho Trust Bank does not provide tax or legal advice.

5. Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate

in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, and differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may in-clude higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. No represen-tation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fee before you invest.

6. Portfolios are illustrative only. ActualLifeNeedsTM Portfolios will vary from time to time as determined by Idaho Trust Bank. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested investment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest. Past performance is no guarantee of future results.

Exchange Traded Funds (ETF), mutual funds and individual stocks are subject to risks and fluctuate in value. Neither asset allocation nor diversification assure a profit or protect against loss. International investing involves special risks including increased volatility, political risks, differences in auditing and other financial standards. Small-cap stocks have historically experienced greater volatility than average. High yield, lower-rated securities generally entail greater market, credit and liquidity risks than investment grade securities and may include higher volatility and higher risk of default. Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. Past performance is no guarantee of future results. For more information about performance of Idaho Trust Strategies and our performance calculation methodology, please contact us. Actual client performance may vary from the performance of model portfolios and/or any strategy. No representation is hereby made of the risk and/or return of any particular portfolio. There is no guarantee that any suggested invest-ment strategy will work in any market. You should fully and carefully consider all objectives, risks, expenses and fees before you invest.

Portfolios are illustrative only. Actual LifeNeeds™ Portfolios will vary from time to time as determined by Idaho Trust Bank. The Idaho Trust investment strategies will vary from time to time as determined by Idaho Trust Bank. The information and analysis expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. Information contained herein has been obtained by sources we consider reliable, but is not guaranteed. Any opinions expressed are based on our interpretation of data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice.

NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT GUARANTEED BY THE BANK • MAY GO DOWN IN VALUE

Rev. 9.30.21 ©Idaho Trust Bank, 2020. All Rights Reserved.